Asante Provides an Update on Bibiani and Chirano Exploration

VANCOUVER, British Columbia, Oct. 06, 2025 (GLOBE NEWSWIRE) -- Asante Gold Corporation (TSXV:ASE | GSE:ASG OTCQX:ASGOF) (“Asante” or the “Company”), an emerging Ghana-focused mid-tier gold producer, is pleased to provide an exploration update on the Company’s Bibiani Gold Mine (“Bibiani”) and Chirano Gold Mine (“Chirano”) for year-to-date 2025. Asante's exploration focus remains upon extending mine life at existing operations and testing near mine opportunities.

Year-to-date 2025 Exploration Highlights

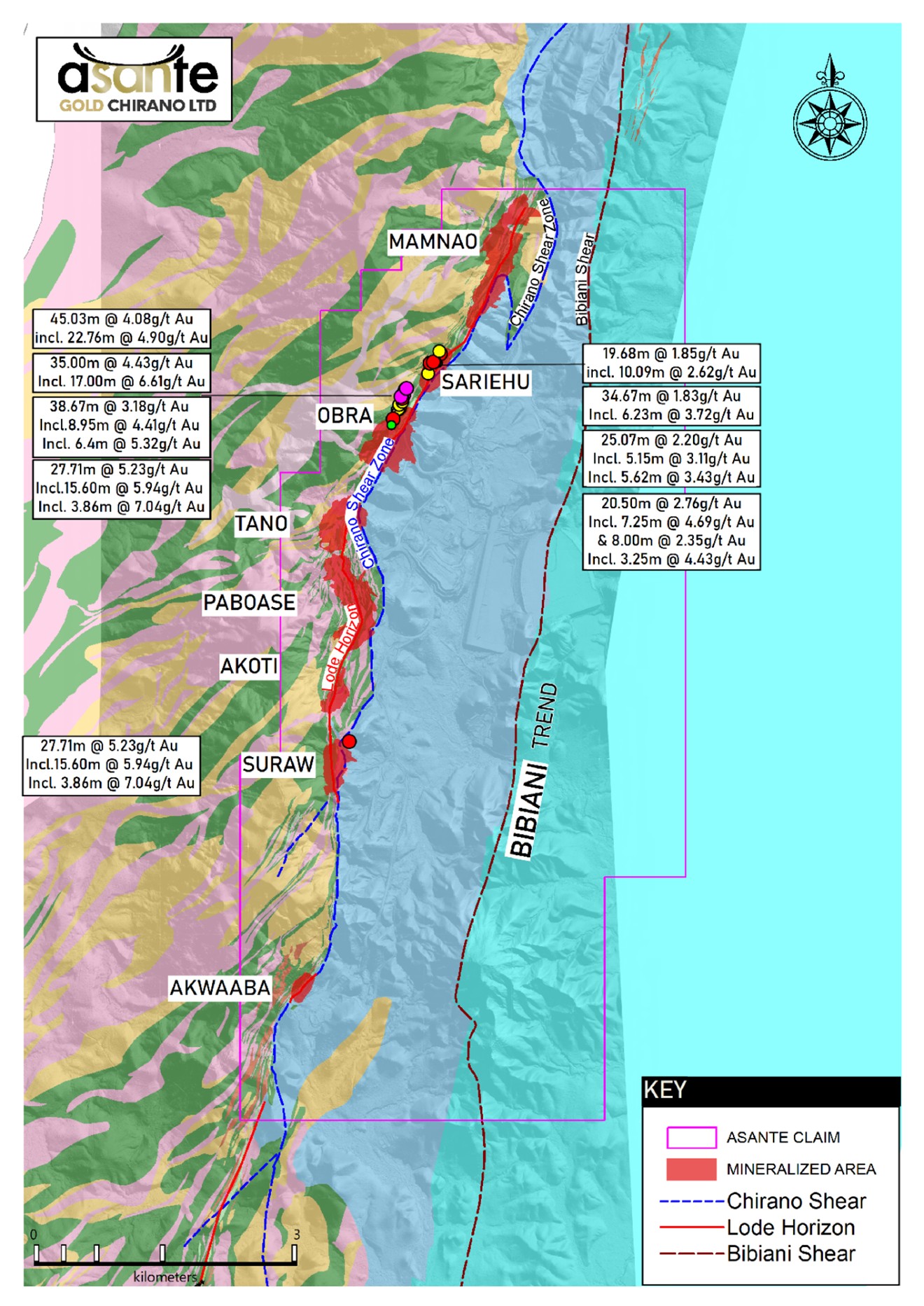

Chirano Exploration

- Exploration drilling has continued to yield highly encouraging results, particularly in areas beyond the current reserve and resource envelopes.

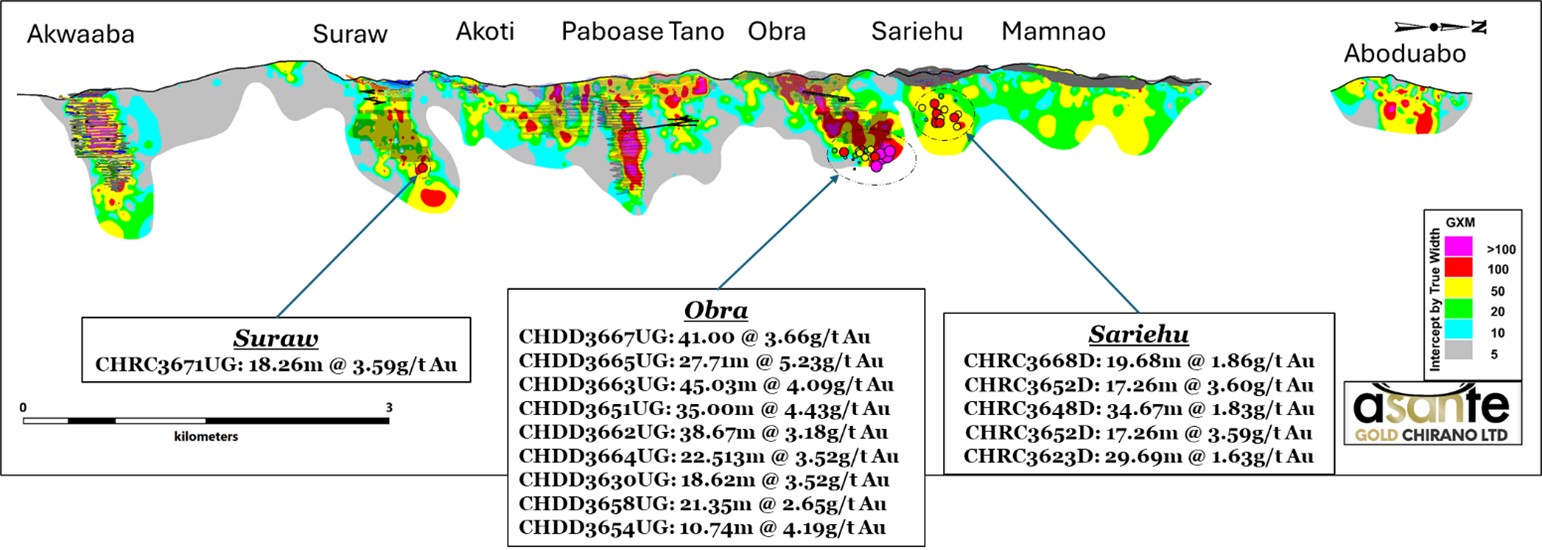

- Significant progress was made at Obra Underground (“Obra”), Suraw Underground (“Suraw”) and Sariehu, where drilling intersected strong mineralization, supporting the potential for resource growth and mine life extension.

- New intercepts and assay results at Obra, Suraw, Sariehu and Magnetic Hinge returned high-grade intervals as follows:

- CHDD3663UG – 45.03 metres (m) @ 4.09 grams per tonne (g/t) gold (Au), including 20.71m @ 4.91 g/t Au (Obra)

- CHDD3651UG – 35.00m @ 4.43g/t Au including 17.20m @ 6.62 g/t Au (Obra)

- CHDD3665UG – 27.71m @ 5.23g/t Au including 16.11m @ 5.95 g/t Au (Obra)

- CHDD3671UG – 18.26m @ 3.60g/t Au including 6.60m @ 5.72 g/t Au (Suraw)

- CHRC3652D – 29.20m @ 1.57g/t Au including 9.10m @ 2.20 g/t Au (Sariehu)

- CHRC3652D – 34.67m @ 1.83g/t Au including 6.23m @ 3.72 g/t Au (Sariehu)

- CHRC3647D – 17.90m @1.48g/t Au including 7.40m @1.81 g/t Au (Magnet Hinge)

- A total of 126 holes for 13,561m of drilling (RC – 2,438.0m; DD – 9,610.0m; Auger - 1,513.0m) has been completed year-to-date 2025, representing 43% of 2025 drilling.

Bibiani Exploration

- Exploration has focused on following up on greenfield targets generated in 2024 on both the mining lease and prospecting licences, and drill testing more mature brownfields targets adjacent to the current mining areas.

- Geophysical and geochemical programs completed in 2024 defined targets for further field investigation in 2025 through rock chip sampling, mapping, and reverse circulation (RC) drilling.

- A total of 126 holes for 19,271m of drilling (RC – 16,639.0m; DD – 2,632.0m) has been completed year-to-date 2025, representing 63% of 2025 drilling.

Dave Anthony, CEO of Asante, commented,

“We completed our $500M financing initiative in August 2025. More than $9M of this financing has been allocated to each of Chirano and Bibiani, to accelerate near mine exploration in 2025 and support long term planning of mining activities and gold production.

“Results to date have been instrumental in reaffirming the potential for resource growth and mine life extension at our existing operations. With drilling at Obra confirming the extension of a mineralized shoot and its structural connection to the Sariehu deposit at depth, we are encouraged to advance our efforts at Chirano to extend the life of mine.

“We are encouraged by these results and look forward to continued success. Moreover, we are excited to learn how our exploration initiative will impact the NI 43-101 Technical Reports, currently being updated for each mine and scheduled for release in April 2026.”

Chirano Exploration

A key success thus far in 2025 has been at Obra Underground, where drilling confirmed the extension of a high-grade mineralized shoot (>2.5 g/t Au) with positive structural linkage to the Sariehu deposit at depth. The deepest hole drilled so far in 2025 returned an exceptional intercept of 27.71m grading 5.23 g/t Au (true width), including 15.60m at 5.94 g/t Au. Similarly, the first drill hole at Suraw returned 18.26m at 3.60 g/t Au (true width), including 6.56m grading 5.71 g/t Au (true width), highlighting Suraw’s underexplored potential and the structural connection along the trend. Drilling at Sariehu also returned encouraging intercepts, further validating the depth potential and its integration into a broader underground mining strategy for the Chirano district.

An exciting development was the advancement of near-surface oxide mineralization at the Magnetic Hinge deposit, located approximately 3.0km south of Akwaaba. Drilling results at Magnetic Hinge were positive enough to warrant the advancement of the project to pre-feasibility study (PFS) stage, signaling a potential new source of shallow, easily mineable oxide material that could support short to medium-term production strategies.

In parallel, greenfield exploration efforts, including detailed geological mapping, and geophysical surveys were conducted across the Anansu Prospecting License (PL). These efforts successfully delineated eight drill-ready targets supported by encouraging grab samples averaging +1.0 g/t Au across a mineralized corridor of approximately 2.0km. These targets represent promising near-surface oxide potential and are scheduled for drill testing in the next campaign.

Looking ahead to the fourth quarter 2025 and into 2026, exploration efforts will focus on upgrading resources, extending shoots and identifying targets, with the goal of increasing the life of mine at Chirano. Continued exploration will target the deepening and lateral extension of mineralized structures, as well as evaluating new exploration opportunities to enhance the resource base especially at Obra, Sariehu, Suraw, Mamnao North and drill testing the western parallel splays. Approximately 15,000m of drilling is planned for the remainder of the year.

Drill Results

Table 1.0 - 2025 Chirano Exploration summary drill results (Obra, Sariehu, Mag Hinge, Suraw)

| From | To | Interval | True Width | Au | |||

| Project | Hole ID | (m) | (m) | (m) | (m) | (g/t) | Intercept |

| Obra |

CHDD3638UG | 313.45 | 319 | 5.55 | 4.9 | 3.82 | 4.90m @ 3.82 g/t Au |

| CHDD3630UG | 281 | 305 | 24 | 18.62 | 3.52 | 18.6m @ 3.52 g/t Au | |

| CHDD3630UG | Incl.285 | 300 | 15 | 11.5 | 4.92 | 11.5m @ 4.92 g/t Au | |

| CHDD3633UG | 291 | 304.2 | 13.2 | 10.63 | 3.30 | 10.6 @ 3.30 g/t Au | |

| CHDD3635UG | 328.75 | 336 | 7.25 | 6.35 | 3.07 | 6.4m @ 3.07 g/t Au | |

| CHDD3645UG | 304.65 | 317 | 12.35 | 9 | 4.19 | 9.0m @ 4.19 g/t Au | |

| CHDD3645UG | Incl.306 | 312.25 | 6.25 | 4.55 | 6.49 | 4.6m @ 6.49 g/t Au | |

| CHDD3651UG | 385 | 450 | 65 | 35 | 4.43 | 35.0m @ 4.43 g/t Au | |

| CHDD3651UG | Incl.408 | 440 | 32 | 17.2 | 6.62 | 17.2m @ 6.62 g/t Au | |

| CHDD3654UG | 364 | 377.25 | 13.25 | 10.74 | 4.19 | 10.7m @ 4.19 g/t Au | |

| CHDD3656UG | 348.2 | 355.6 | 7.4 | 6.44 | 3.52 | 6.4m @ 3.52 g/t Au | |

| CHDD3656UG | Incl.351 | 355.6 | 4.6 | 4 | 4.78 | 4.0m @ 4.78g/t Au | |

| CHDD3657UG | 349.9 | 357 | 7.1 | 3.51 | 1.69 | 3.5m @ 1.69 g/t Au | |

| CHDD3658UG | 303 | 329 | 26 | 21.35 | 2.65 | 21.4m @ 2.65 g/t Au | |

| CHDD3658UG | Incl.311 | 323 | 12 | 9.85 | 3.87 | 9.9m @ 3.87 g/t Au | |

| CHDD3661UG | 306 | 316 | 10 | 7.57 | 3.00 | 7.6m @ 3.00 g/t Au | |

| CHDD3661UG | Incl.311 | 316 | 5 | 3.78 | 4.98 | 3.9m @ 4.98 g/t Au | |

| CHDD3662UG | 411 | 464 | 53 | 38.67 | 3.18 | 38.7m @ 3.18 g/t Au | |

| CHDD3662UG | Incl. 425 | 438.8 | 13.8 | 10.06 | 4.42 | 10.1m @ 4.42 g/t Au | |

| CHDD3663UG | 345.5 | 418.55 | 73.05 | 45.03 | 4.09 | 45.0m @ 4.09 g/t Au | |

| CHDD3663UG | Incl. 384.4 | 418 | 33.6 | 20.71 | 4.91 | 20.7m @ 4.91 g/t Au | |

| CHDD3664UG | 356 | 393 | 37 | 22.51 | 3.52 | 22.5m @ 3.52 g/t Au | |

| CHDD3664UG | Incl.365 | 386 | 21 | 12.77 | 4.85 | 12.8m @ 4.85 g/t Au | |

| CHDD3665UG | 426 | 469 | 43 | 27.71 | 5.23 | 27.7m @ 5.23 g/t Au | |

| CHDD3665UG | Incl.429 | 454 | 25 | 16.11 | 5.95 | 16.1m @ 5.95 g/t Au | |

| CHDD3667UG | 351.4 | 359 | 7.6 | 4.3 | 2.28 | 4.3m @ 2.28 g/t Au | |

| CHDD3667UG | 385 | 457 | 72 | 41 | 3.66 | 41.0m @ 3.66 g/t Au | |

| CHDD3667UG | Incl.405 | 442 | 37 | 21 | 5.66 | 21.0m @ 5.66 g/t Au | |

| CHDD3667UG | Incl.414 | 424.35 | 10.35 | 5.9 | 10.39 | 5.9m @ 10.39 g/t Au | |

| Sariehu |

CHRC3631D | 309.4 | 320 | 10.6 | 9.85 | 1.88 | 9.9m @ 1.88 g/t Au |

| CHRC3632D | 459.3 | 469 | 9.7 | 8.27 | 2.25 | 8.3m @ 2.25 g/t Au | |

| CHRC3632D | 515.25 | 531 | 15.75 | 13.67 | 2.13 | 13.7m @ 2.13 g/t Au | |

| CHRC3632D | Incl. 516.3 | 519 | 2.7 | 2.5 | 4.11 | 2.5m @ 4.11 g/t Au | |

| CHRC3648D | 520 | 566 | 46 | 34.67 | 1.83 | 34.7 @ 1.83 g/t Au | |

| CHRC3652D | 549.5 | 583.8 | 34.3 | 29.19 | 1.57 | 29.2m @ 1.57 g/t Au | |

| CHRC3652D | Incl. 551 | 562 | 11 | 9.14 | 2.20 | 9.1m @ 2.20 g/t Au | |

| CHRC3652D | 596.55 | 616.45 | 19.9 | 17.26 | 3.60 | 17.3m @ 3.60 g/t Au | |

| Sariehu |

CHRC3652D | Incl. 607 | 616.45 | 9.45 | 8.94 | 5.47 | 8.9m @ 5.47 g/t Au |

| CHRC3668D | 538.5 | 562 | 23.5 | 19.68 | 1.86 | 19.7m @ 1.81 g/t Au | |

| CHRC3668D | Incl.540.4 | 552.45 | 12.05 | 10.09 | 2.62 | 10.1m @ 2.62 g/t Au | |

| Magnetic Hinge |

CHRC3640 | 62 | 66 | 4 | 3.6 | 1.46 | 3.6m @ 1.46 g/t Au |

| CHRC3642 | 9 | 13 | 4 | 3.53 | 0.92 | 3.5m @ 0.92 g/t Au | |

| CHRC3643 | 47 | 56 | 9 | 8.27 | 1.42 | 8.3m @ 1.42 g/t Au | |

| CHRC3643 | Incl. 49 | 54 | 5 | 4.96 | 1.85 | 5.0m @ 1.85 g/t Au | |

| CHRC3644 | 86 | 94 | 8 | 7.61 | 2.00 | 7.6m @ 2.00 g/t Au | |

| CHRC3646 | 138 | 144 | 6 | 5.25 | 3.91 | 5.3m @ 3.91 g/t Au | |

| CHRC3647D | 119 | 138 | 19 | 17.85 | 1.48 | 17.9m @ 1.48 g/t Au | |

| CHRC3647D | Incl. 120 | 129.55 | 9.55 | 7.36 | 1.81 | 7.4m @ 1.81 g/t Au | |

| CHDD3650 | 168.45 | 177 | 8.55 | 8.01 | 0.82 | 8.0m @ 0.82 g/t Au | |

| Suraw |

CHDD3671UG | 282.15 | 310 | 27.85 | 18.26 | 3.60 | 18.3m @ 3.60 g/t Au |

| CHDD3671UG | Incl.294 | 304 | 10 | 6.56 | 5.72 | 6.6m @ 5.72 g/t Au |

Chirano Exploration Highlights Year-to-date

Figure 1.0 - Grade X Width Long Section Plot of year-to-date drilling results from Chirano.

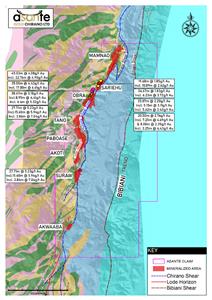

Figure 2.0 - Chirano Geology Map with Highlighted 2025 Drill Intercepts within the Mining Lease

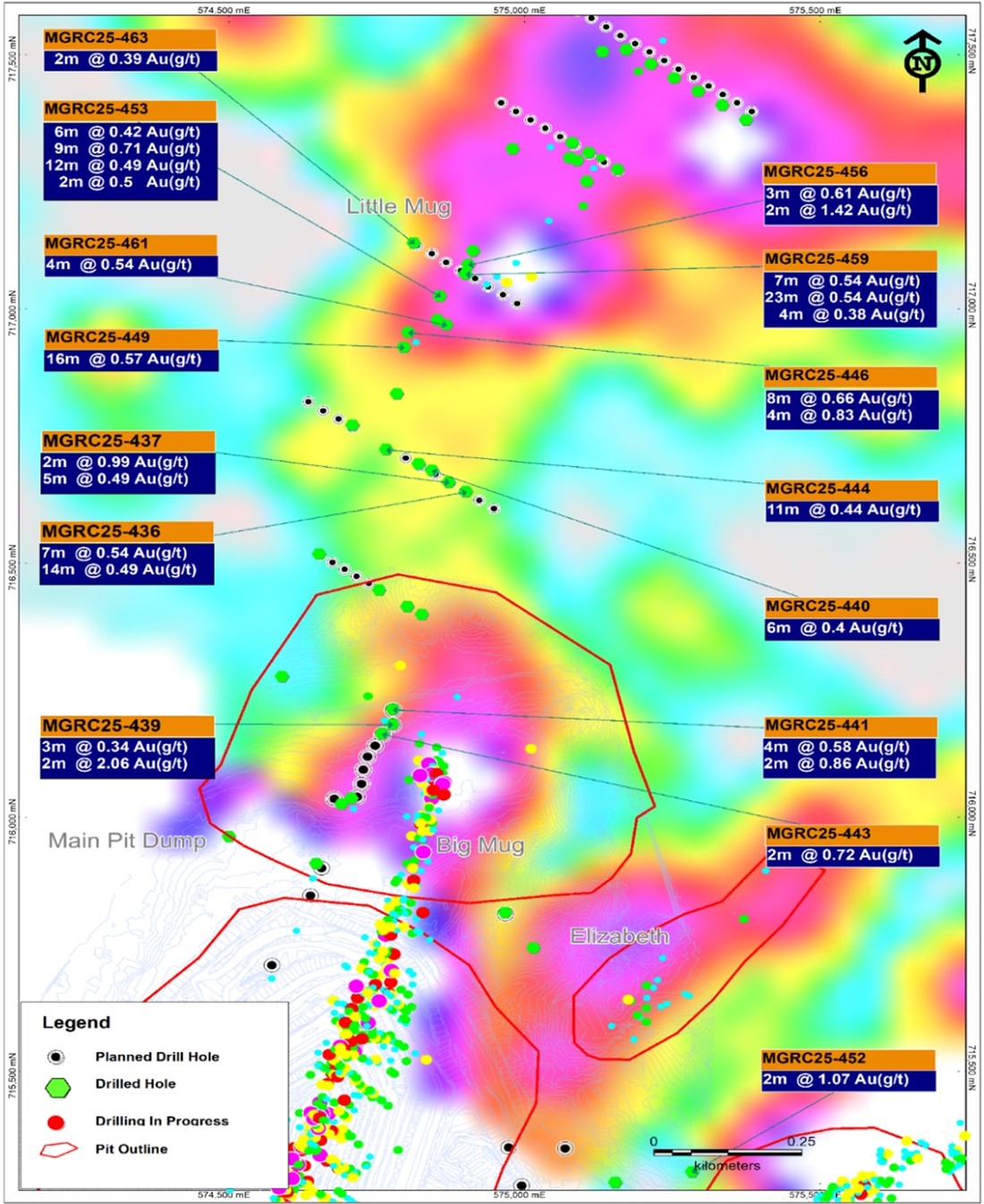

Bibiani Exploration

Results from the ground truthing and initial drill testing are pointing to successful early-stage discoveries of new near surface oxide mineralization at Pamunu, Little Mug and Asempaneye prospects, which are currently undergoing additional drilling to define the full potential.

Detailed geological mapping and rock chip sampling of select targets following the integrated targeting exercise has led to identification of several targets, confirmation of the bedrock source of gold mineralization and further geological understanding of the host rock and structural controls of gold mineralization in the Yaro-Bredi Domain on the Asuontaa PL and the Asempaneye–Fawoman-SWT domain of the Bibiani mining license (ML).

Initial drill testing at the Little Mug and Pamunu prospects over anomalous soil geochemical (>+ 80ppb) trends have confirmed the presence of mineralized shear zones (possibly 2/3 splay structures) associated with sediments, intrusive host rocks and disseminated fine grained pyrite.

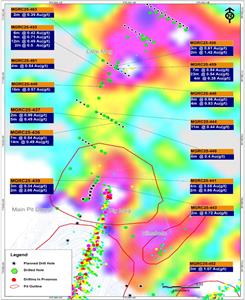

Figure 3.0 - Little Mug and Big Mug Drilling shown over Au-in-Soil Geochemistry

A total of 126 holes for 19,271m of drilling (RC – 16,639.0m and DD – 2,632.0m) has been completed year-to-date 2025, with an additional 25,000m of RC projected to be drilled in the first half of 2026.

Looking ahead to the fourth quarter 2025 and into 2026, exploration efforts will continue to focus on defining initial resources at Little Mug, Asempaneye, and the Yaro-Bredi Domain.

Quality Assurance

Asante employs a QA/QC program consistent with NI 43-101 and industry best practices. Drilling was conducted by GTS Drilling Services and Toomahit Drilling Limited and was supervised by the Asante exploration teams. Selected drill core intervals were sawn in half with a diamond blade saw. Half of the sampled core was left in the core box and the remaining half was bagged and sealed. Asante utilizes accredited laboratories, and the samples were transported to either ALS-Kumasi or the Intertek laboratory in Tarkwa, Ghana. Gold was analyzed by 50-gram fire assay with Atomic Absorption-finish. Certified reference material (CRM) standards and coarse blank material are inserted every 20 samples.

Qualified Person (“QP”)

The scientific and technical information contained in this news release has been reviewed and approved by Dean Bertram, Vice President of Geology of Asante, who is a “qualified person” under NI 43-101.

About Asante Gold Corporation

Asante is a gold exploration, development and operating company with a high-quality portfolio of projects and mines in Ghana. Asante is currently operating the Bibiani and Chirano Gold Mines and continues with detailed technical studies at its Kubi Gold Project. All mines and exploration projects are located on the prolific Bibiani and Ashanti Gold Belts. Asante has an experienced and skilled team of mine finders, builders and operators, with extensive experience in Ghana. The Company is listed on the TSX Venture Exchange and the Ghana Stock Exchange. Asante is also exploring its Keyhole, Fahiakoba and Betenase projects for new discoveries, all adjoining or along strike of major gold mines near the centre of Ghana’s Golden Triangle. Additional information is available on the Company’s website at www.asantegold.com.

For further information please contact:

Dave Anthony, President & CEO

Frederick Attakumah, Executive Vice President and Country Director

info@asantegold.com

+1 604 661 9400 or +233 303 972 147

Cautionary Statement on Forward-Looking Statements

Certain statements in this news release constitute forward-looking statements or forward-looking information. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: exploration results, exploration potential, potential resource expansion, potential mine life extension, timing of updated technical reports and quantity of planned drilling for the remainder of 2025. These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: the impact of inflation and disruptions to the global, regional and local supply chains; tonnage of mineralized material to be mined and processed; future anticipated prices for gold and assumed foreign exchange rates; the timing and impact of planned capital expenditure projects, including anticipated sustaining, project, and exploration expenditures; risks related to increased barriers to trade, including tariffs and duties; ore grades and recoveries; capital, decommissioning and reclamation estimates; our mineral reserve and mineral resource estimates and the assumptions upon which they are based; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour-related disruptions at any of our operations; no unplanned delays or interruptions in scheduled production; all necessary permits, licenses and regulatory approvals for our operations are received in a timely manner; our ability to secure and maintain title and ownership to mineral properties and the surface rights necessary for our operations, including contractual rights from third parties and adjacent property owners; whether the Company is able to maintain a strong financial condition and have sufficient capital, or have access to capital, to sustain our business and operations; and our ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to, the duration and effect of local and world-wide inflationary pressures and the potential for economic recessions; fluctuations in the price of gold; fluctuations in currency markets; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom the Company does business; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; employee relations; relationships and claims by local communities; changes in laws, regulations and government practices in the jurisdictions where we operate, including environmental, export and import laws and regulations; changes in national and local government, legislation, taxation, controls or regulations and political, legal or economic developments in countries where the Company may carry on business, including legal restrictions relating to mining, risks relating to expropriation; variations in the nature, quality and quantity of any mineral deposits that may be located, the Company’s inability to obtain any necessary permits, consents or authorizations required for its planned activities, the Company’s inability to raise the necessary capital or to be fully able to implement its business and growth strategies, and those risk factors identified in the Company’s management’s discussions and analysis and the most recent annual information form. The reader is referred to the Company’s public disclosure record which is available on SEDAR (www.sedarplus.ca). Although the Company believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except as required by securities laws and the policies of the securities exchanges on which the Company is listed, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

LEI Number: 529900F9PV1G9S5YD446. Neither IIROC nor any stock exchange or other securities regulatory authority accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ae5ed05-3250-4ed5-a720-fac8203c72dd

https://www.globenewswire.com/NewsRoom/AttachmentNg/52b9fa6d-5a0f-4ed7-8f6a-75927865eef1

https://www.globenewswire.com/NewsRoom/AttachmentNg/b92728b1-1a14-4c55-bbd1-46465e9d66d1

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.